Reverse charge for VAT

Set up shops to sell goods across EU-borders without charging VAT

As per EU-legislation, B2B shops are allowed to sell goods and services across EU-borders without charging VAT if the buyer has a valid VAT number. Please note, that it is the responsibility of the seller to verify that the customer has a valid VAT number, for example by using the VIES service.

To activate the Reverse Charge for VAT, which essentially means not charging VAT to specific customers, you have two choices:

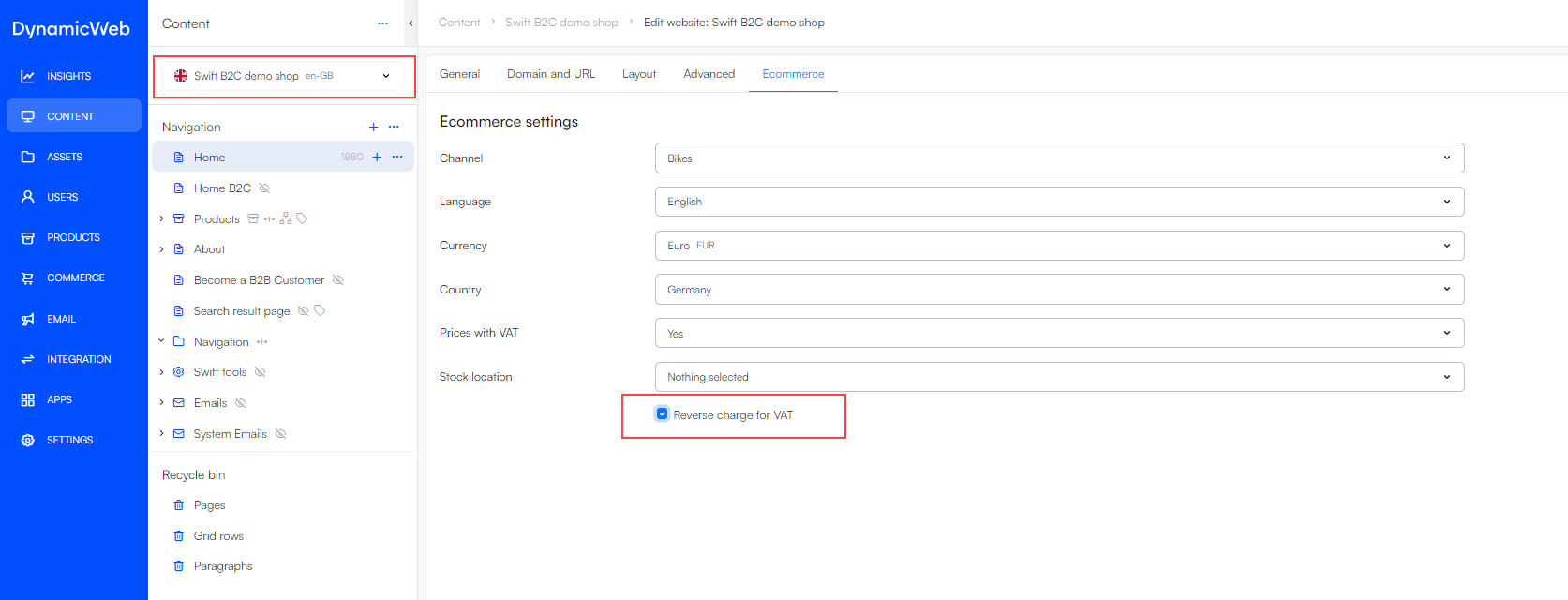

- Either activate reverse VAT for all customers, making sure all customers have a valid VAT number. Open the website Ecommerce-settings and check the Reverse Charge for VAT field for the relevant website(s)

- Or enabling reverse VAT for some customers, by enabling it only for those with valid VAT number.

The Reverse Charge is now activated, and we need to configure how we will apply it in our solution.

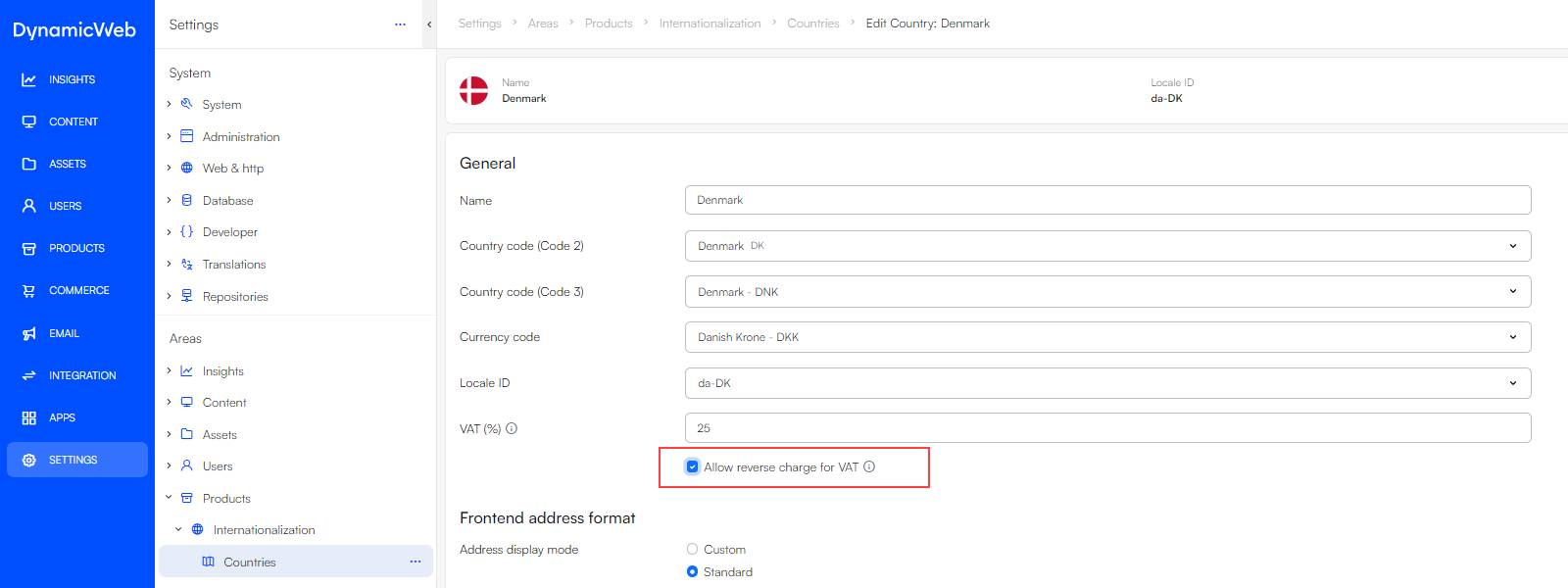

Option 1: Applying the reverse charge for VAT to all products within a country

- Go to Settings > Areas > Products > Internationalization > Countries

- Locate the country where you want to apply the reverse VAT charge and click it

- Check the "Allow reverse charge for VAT" field

This configuration ensures that authenticated users marked for reverse charge for VAT will see prices without VAT when making deliveries to this country.

Option 2: Applying the reverse charge for VAT to specific products

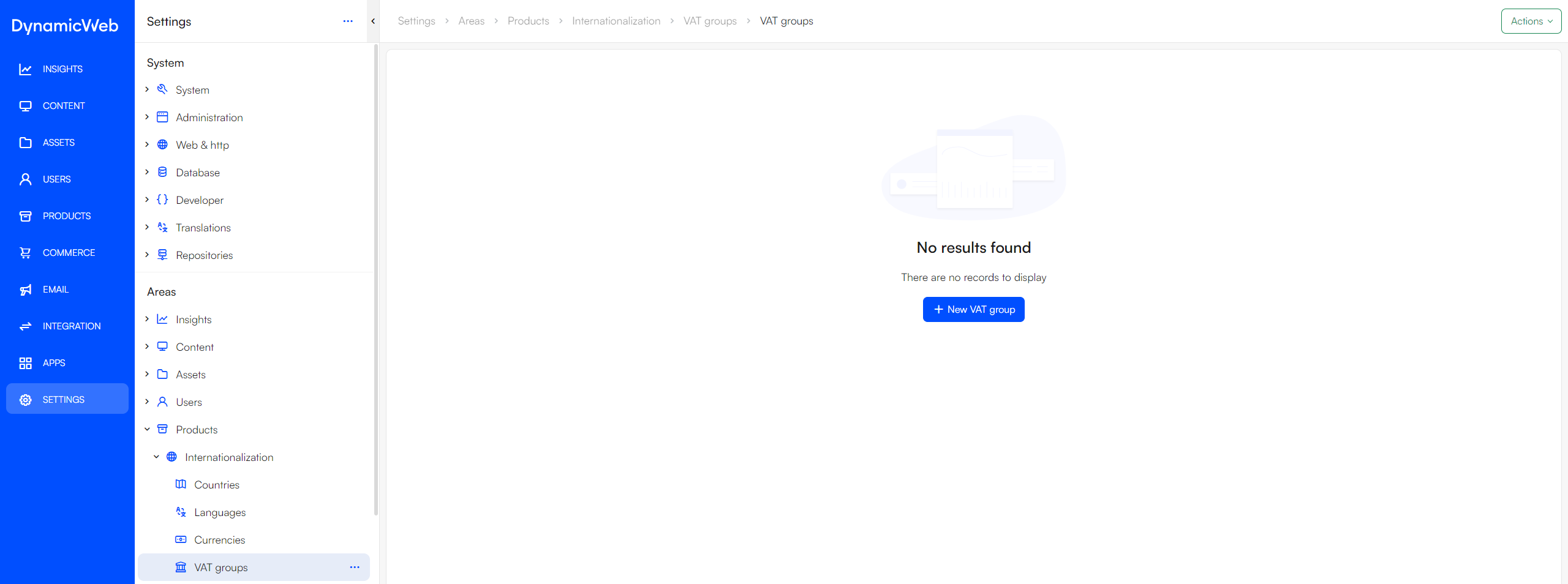

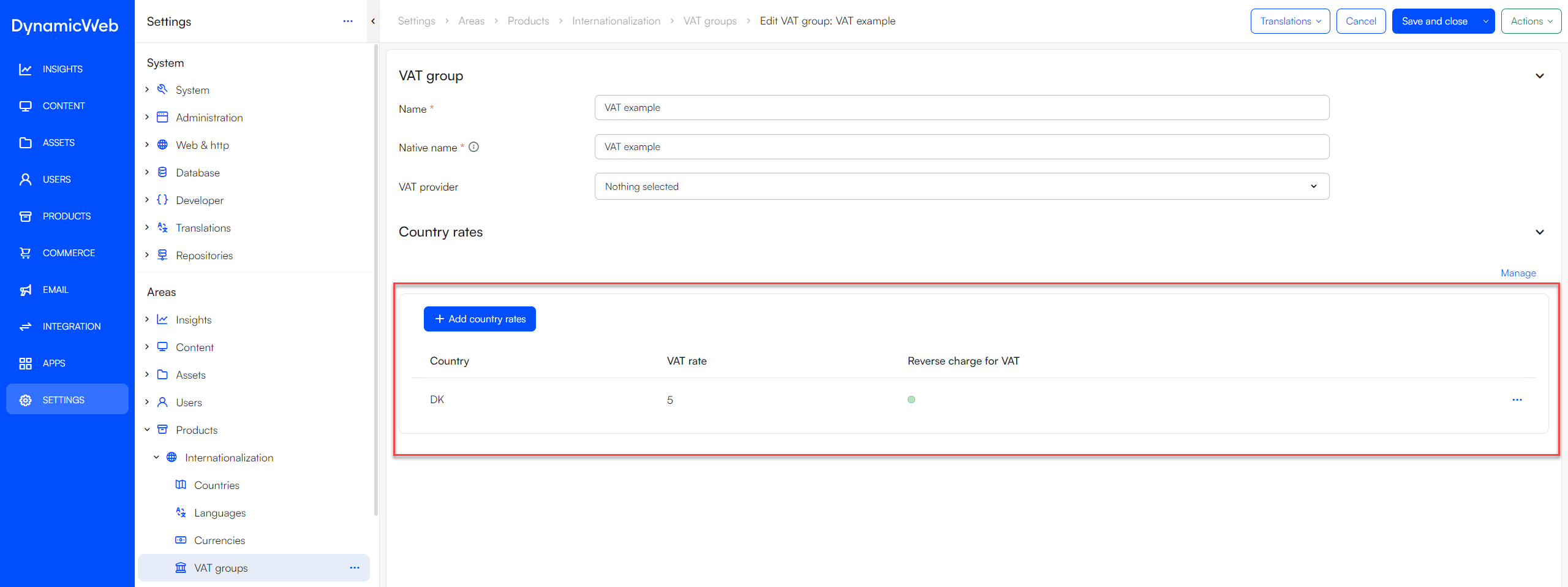

Firstly, you need to create a VAT group:

- Go to Settings > Areas > Products > Internationalization > VAT groups

- Click "+ New VAT group"

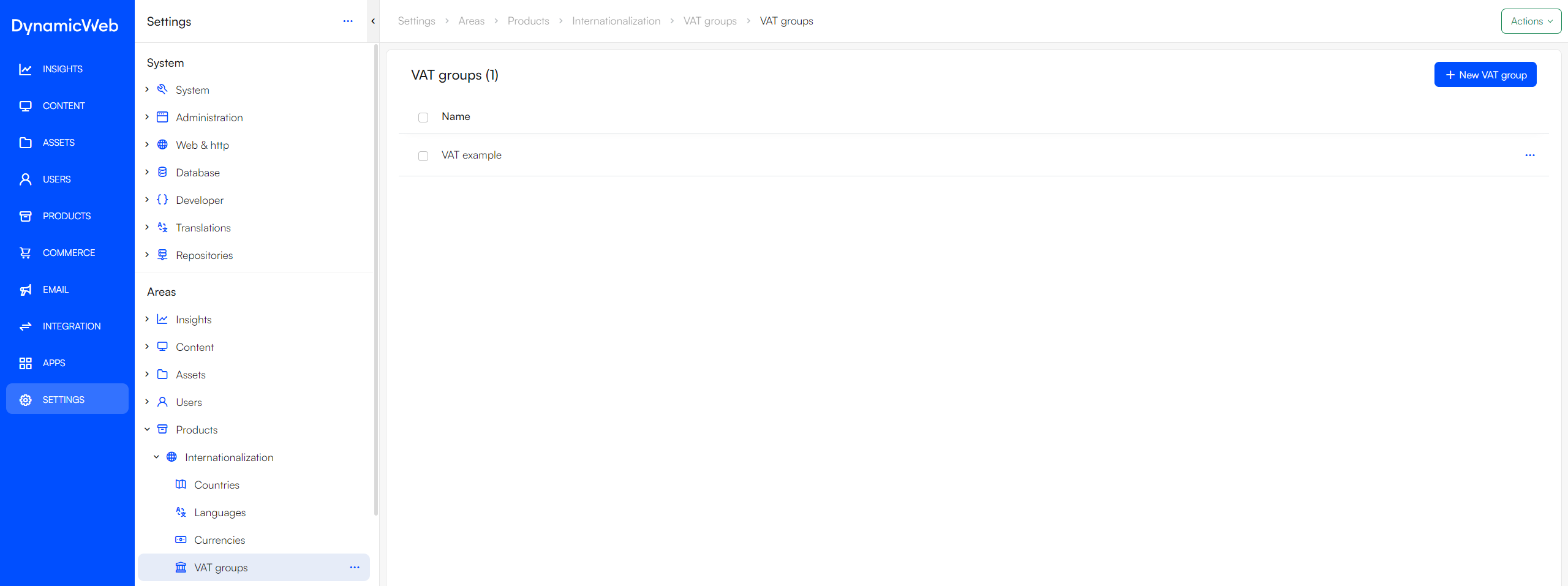

- Provide the group with a name and a native name(system name)

- Optionally, provide the VAT group with a VAT provider

- Save and close

- Click the newly create VAT group

- Click the "+ Add country rate" to specify the differentiated VAT for each country

- Select the country to make the VAT group effect

- Set the VAT rate

- Check "reverse charge for VAT"

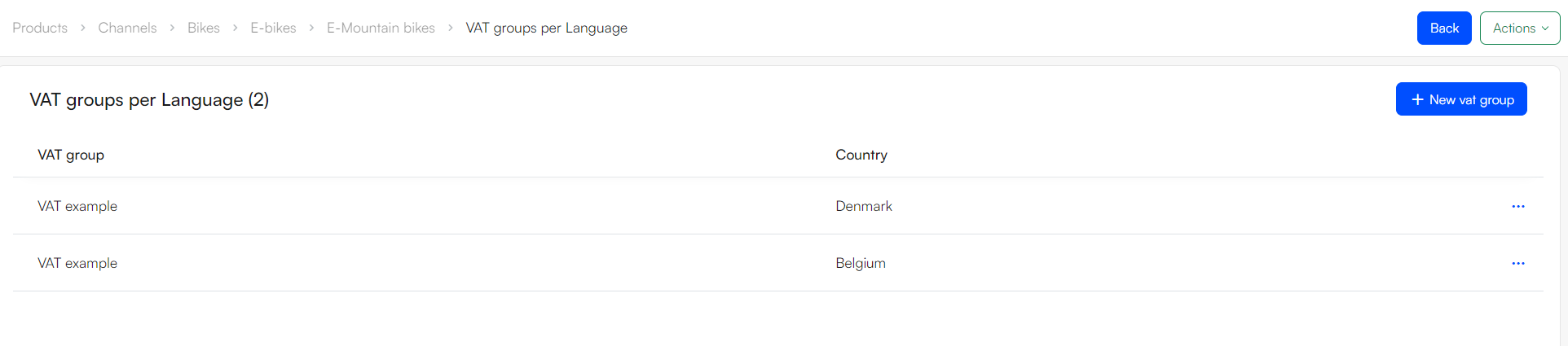

The VAT group is now ready to be assigned to products:

- Go to the product you want to assign the VAT

- Click the Action menu and select "VAT groups"

- Click "+ New VAT group"

- Select the VatGroupId and CountryID

- The CountryID specifies which countries this VAT will be applied

- The CountryID specifies which countries this VAT will be applied